copyright is revolutionizing finance, providing investors with unique opportunities. However, navigating this volatile landscape can be daunting. To truly unlock the potential of copyright investment, it's crucial to develop a sound understanding of the mechanics. This includes exploring different cryptocurrencies, recognizing market trends, and utilizing risk management strategies. Remember, patience and commitment are key to attaining long-term success in the dynamic world of copyright.

- Explore diverse investment opportunities.

- Diversify your portfolio across different copyright assets.

- Stay informed about market news and developments.

Bitcoin vs. Gold: The Ultimate Showdown

The digital realm of finance is witnessing a fascinating clash: Bitcoin, the revolutionary blockchain-based currency, versus Gold, the time-honored safe haven. Both assets have captivated investors seeking stability, sparking a discussion about which reigns supreme. Bitcoin, with its unpredictable nature and potential for exponential returns, attracts adventurers. Gold, on the other hand, offers a more traditional approach, providing a hedge against inflation during uncertain times. Ultimately, the choice between Bitcoin and Gold depends on an individual's financial goals, making this a dynamic battle for dominance in the modern asset world.

Exploiting the copyright Market for Sustainable Gains

Venturing into the volatile landscape of cryptocurrencies can be a daunting endeavor. While chances abound for substantial profits, navigating this complex market requires a strategic approach. Sustainable success hinges on factors like portfolio allocation, thorough research, and a keen understanding of market trends. Embrace cutting-edge tools, stay informed on the latest developments, and hone your analytical skills to enhance your chances of achieving long-term profitability in this ever-evolving market.

- Consider different copyright investments

- Set clear trading goals

- Develop a well-defined plan

copyright Trading Strategies for Success

Diving into the dynamic world of copyright investing can be exciting, but it also demands a strategic approach. To maximize your chances of success, consider implementing these key strategies. First and foremost, perform thorough investigation on the cryptocurrencies you're interested in. Understand their underlying technology, team backgrounds, and trading sentiment.

Next, develop a well-defined investment plan. Determine your risk tolerance, investment goals, and the portion of your portfolio you're willing to devote to copyright. Remember, it's crucial to only trade what you can afford to risk.

- Diversify your portfolio across different cryptocurrencies and blockchain technologies to mitigate risk.

- Employ technical analysis tools and market indicators to identify potential trading trends.

- Stay updated on the latest news, regulations, and developments within the copyright industry.

Security is paramount in the copyright space. Use secure wallets, enable two-factor authentication, and be cautious of phishing scams and other online threats.

The Allure of Digital Gold: Bitcoin's Rise to Prominence

Bitcoin has seized the imagination of investors and tech enthusiasts alike, rapidly climbing to prominence in the financial world. This digital currency, born from the minds of anonymous developers, has upended traditional notions of currency. Its autonomous nature, free from regulatory control, has {appealed to those seeking distinct investment opportunities. While critics remain wary, Bitcoin's increasing adoption and dynamic price movements continue to fuel its fascination.

Despite its fundamental volatility, nvidia trading views Bitcoin has built itself as a player in the global financial landscape. Its potential remains ambiguous, but one thing is clear: Bitcoin's influence on the world of economics is undeniable.

Diversifying Your Portfolio with copyright and Precious Metals

Adding digital assets and physical assets to your portfolio can be a strategic move for enhancing diversification. While traditional securities like stocks and bonds provide a foundation, integrating these alternative asset classes can potentially mitigate volatility and offer new avenues for growth. Cryptocurrencies, known for their volatility, can balance losses in other sectors of your portfolio during market downturns. Precious metals, historically seen as a safe haven asset, tend to perform well during periods of monetary instability.

- Before incorporating copyright or precious metals, conduct thorough research and understand their respective inherent factors.

- Allocate your investments across different types of cryptocurrencies and precious metals to minimize impact

- Consider your overall financial goals and risk tolerance when determining the appropriate allocation for these alternative assets.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Yasmine Bleeth Then & Now!

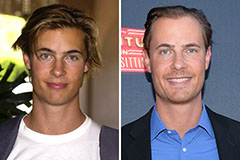

Yasmine Bleeth Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!